DIVERSIFICATION

Why Add Real Estate To Your Portfolio

Cashflow

After all expenses are paid, quarterly distributions go out to investors.

stability

Multifamily is less volatile and continues to outperform traditional stock based investments.

tax benefits

Depreciation is a tax write-off that enables you to keep more of your profits.

leverage

You can leverage real estate, this allows you to buy a $10M property with only $2.5M.

amortization

Residents pay down debt which creates equity, this leads to long-term wealth.

APPRECIATION

Forced appreciation through strategic value plays increase the overall value of the property.

WHY INVEST WITH US

How can we offer such high rates?

Choosing the “right” multi-family apartment complex to acquire is a critical aspect of CS3 Investments, investment strategy. We are diligent in our exploration and focus on opportunities in emerging markets, where jobs and local economies are expanding.

$60 Million

Current Portfolio Value

26%

Avg. Projected ARR

1,200 Units

Under Management

6.25%

Target Investor COC

PROVEN TRACK RECORD

Some Of Our Recent Investments

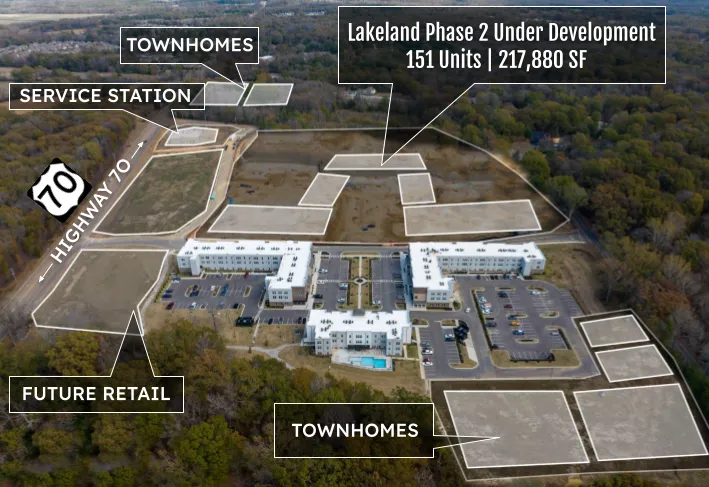

Lakeland Townsquare

Lakeland,Tennessee

The Gateway Village

Murfreesboro, Tennessee

Legends at Armour Avenue

Columbus, Georgia

The Heights Collection

Houston, Texas

Las Olas Walk

Fort Lauderdale, Florida

PROVEN TRACK RECORD

Some Of Our Recent Investments

Lakeland Townsquare

Lakeland, Tennessee

The Gateway Village

Murfreesboro, Tennessee

Legends at Armour Avenue

Columbus, Georgia

The Heights Collection

Houston, Texas

Las Olas Walk

Fort Lauderdale, Florida

STILL NOT SURE ABOUT INVESTING?

LISTEN TO SOME OF OUR INVESTORS:

CONTACT

9360 Federal Blvd

Denver, CO 80260

*As of January 10, 2022.

Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of data provided by investors or other third parties. Neither CS3 Investments nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax or legal adviser before making any investment decision.

CONTACT

9360 Federal Blvd Denver, CO 80260

*As of January 10, 2022.

Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of data provided by investors or other third parties. Neither CS3 Investments nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax or legal adviser before making any investment decision.

All Rights Reserved 2023 | CS3 Investments